15 Cheapest States To Buy a House

March 06th, 2023

Buying a home these days isn't as easy as it once was. In fact, according to the Federal Reserve, the median price of homes in the United States has risen by a whopping 93% over the past decade.

This dramatic increase in home prices has left many people wondering where they should look if they want to buy a house that won't break the bank. Thankfully, some states have been able to fly under the radar and remain relatively affordable, all things considered.

In the list below, we've identified the cheapest state to buy a house (and a few others, in case you're not sold on number one) so you can get to browsing now instead of waiting for a housing market crash that may or may not come.

1. Illinois

-

Median income: $68,988

-

Median home price: $452,130

-

Mortgage-to-income ratio: 11.13%

Illinois has taken the top spot on our list thanks to its low mortgage-to-income ratio, higher-than-average wages and middle-of-the-road home prices. The Land of Lincoln also has a vibrant cultural scene with tons of museums, galleries, and music venues — not to mention some of the country's most iconic attractions, like Chicago's Navy Pier and Millennium Park.

While you can expect a mortgage payment between $1,600 and $2,000 per month if you’re moving to Chicago, payments in rural Alexander County are around $350 per month.

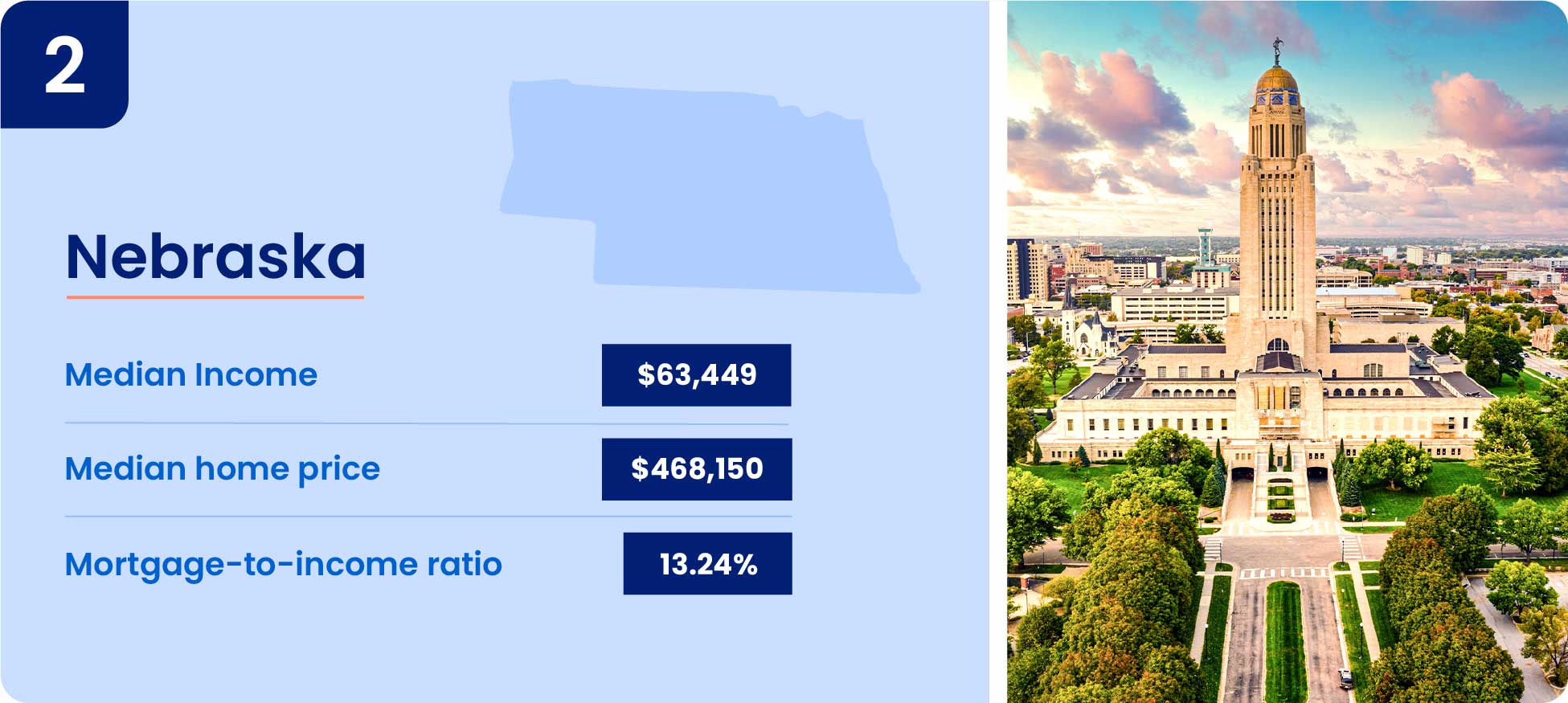

2. Nebraska

-

Median income: $63,449

-

Median home price: $468,150

-

Mortgage-to-income ratio: 13.24%

You might have guessed that Nebraska would score pretty well on this list. It has the eighth lowest utilities cost, fair real estate taxes, and a decent median income, giving it an edge over some of its Midwestern peers. Like Illinois, its low mortgage-to-income ratio has helped it top the list.

Even in its most populous county, Douglas County, which encompasses most of Omaha, average mortgage payments are about $1,350 per month. That makes it a great option for someone looking for a nice balance between affordability and city living.

3. North Dakota

-

Median income: $66,869

-

Median home price: $455,990

-

Mortgage to-income ratio: 13.82%

North Dakota is another affordable option in the Midwest. Though you can expect to pay higher-than-average utilities, average real estate taxes across counties in North Dakota are lower than most other states.

North Dakota is known for its beautiful landscapes and wide range of outdoor activities, making it an ideal spot for budget-minded home buyers who appreciate country living.

4. Kansas

-

Median income: $59,753

-

Median home price: $407,560

-

Mortgage-to-income ratio: 11.85%

Kansas has one of the lowest median home prices and second lowest mortgage-to-income ratio in the country, but it was beat out in the top three due to its high real estate taxes. In fact, average taxes across all counties in the state reach a rate of about 1.4%, the eighth highest in the country.

Kansas still has a lot to offer budget-minded home buyers. If you prefer to live in a city, you might find Kansas City or Wichita to your liking. And if you’re more of a country type, you can search for a spot in the Great Plains or find a town in the east near the Ozarks.

5. South Dakota

-

Median income: $66,413

-

Median home price: $569,300

-

Mortgage-to-income ratio: 13.73%

Of the top 15 most affordable states, South Dakota has the highest median home price. But that doesn’t mean it’s an expensive place to buy a house. Low real estate taxes, cheap utilities, and a low mortgage-to-income ratio make it especially competitive.

The state’s low cost of living, growing job market, and wide-open rural landscape make it an especially attractive option for home buyers of all ages. It's a great place for city people who want to escape the hustle and bustle of urban life or country dwellers who aren’t quite country enough to move to North Dakota.

6. Oklahoma

-

Median income: $55,260

-

Median home price: $348,780

-

Mortgage-to-income ratio: 14.55%

While you might know Oklahoma for its beautiful countryside, it is a surprisingly nice place to live for city folk. Oklahoma City is a lot like Dallas, Texas, but average mortgages are about $200-$500 cheaper per month. And Tulsa is even cheaper!

The state is home to world-class attractions like the Oklahoma City Museum of Art, the Cowboy Hall of Fame, and the Tulsa Zoo. Nature lovers also have plenty to explore with its wildlife reserves, national parks, and even mountain ranges.

7. Arkansas

-

Median income: $51,240

-

Median home price: $418,320

-

Mortgage-to-income ratio: 14.75%

Arkansas is another Southern state offering home buyers an affordable slice of rural paradise. Better yet, it’s got the third lowest real estate taxes in the country. Now, a mortgage in the state’s most expensive county, Benton, is about $1,580 per month, but that’ll put you about 30 minutes away from Hobb State Park and Beaver Lake, a beautiful Ozark oasis.

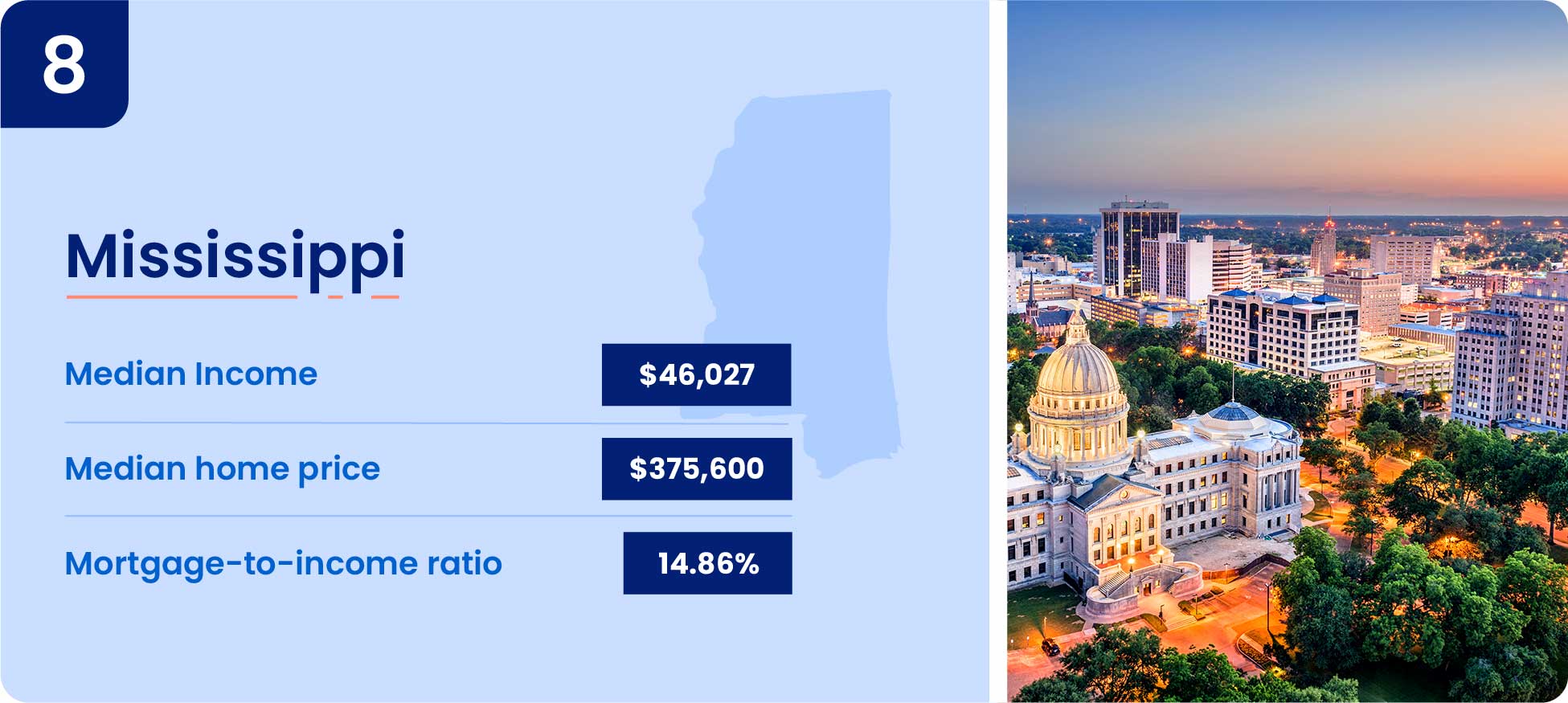

8. Mississippi

-

Median income: $46,027

-

Median home price: $375,600

-

Mortgage-to-income ratio: 14.86%

Mississippi ranks high in just about every affordability category, from home prices to taxes and utilities costs. But it has the lowest median income of any state in the country, meaning it may not be a top choice for career-driven home buyers looking for new opportunities.

The state's main attractions include sandy beaches, lively music venues, plenty of outdoor activities at parks and nature preserves, and the scenic Natchez Trace Parkway. All in all, Mississippi is an ideal destination if you're looking for a slower pace of life with plenty of Southern charm.

9. West Virginia

-

Median income: $49,233

-

Median home price: $305,080

-

Mortgage-to-income ratio: 16.33%

West Virginia boasts the lowest median home price in the country, but its low median income could be off-putting for some. It's a great option for home buyers who are looking for a great quality of life and aren't too caught up in the rat race.

With stunning mountains and plenty of outdoor activities, including whitewater rafting, skiing, and hiking, there's something to do all year round in West Virginia. Not to mention its gorgeous Appalachian foothills with scenic views at every turn — there's a reason John Denver wrote an entire song about it, after all.

10. Iowa

-

Median income: $58,861

-

Median home price: $399,840

-

Mortgage-to-income ratio: 14.88%

Iowa is an underappreciated gem in the Midwest. Not only does it boast the fifth lowest median home prices in the country, but it also has a low cost of living. Although it can be cold and snowy during the winter months, summers are sunny and mild.

With its rolling hills, vast fields of corn and soybeans, and beautiful sunsets, Iowa offers plenty of opportunities to explore the outdoors. And if you’re more of an artsy, city type, Politico even called Des Moines one of the “richest, most vibrant, and, yes, hip cities in the country.”

11. Texas

-

Median income: $62,483

-

Median home price: $503,980

-

Mortgage-to-income ratio: 14.40%

As the third most populous state in the U.S., Texas is a great place for career-driven home buyers looking to make a move. And with affordable homes, decent wages, and low taxes, Texas is a great place to live.

Whether you're looking for a countryside home or an apartment in a big city, you can find exactly what you're looking for in the Lone Star State. Keep in mind, however, that big cities like Austin or Dallas aren't exactly "off the beaten path" and, as such, can cost a pretty penny.

11. Alabama

-

Median income: $50,762

-

Median home price: $475,800

-

Mortgage-to-income ratio: 16.55%

Alabama is another unassuming Southern state with safe places to live that has a lot to offer. From beautiful white sand beaches to outdoor activities like fishing and hiking, Alabama is perfect for those who want to escape the hustle and bustle of city life. Plus, Alabama’s low cost of living and low real estate taxes make it an attractive option for families looking for a new place to call home.

12. Louisiana

-

Median income: $54,436

-

Median home price: $363,780

-

Mortgage-to-income ratio: 16.64%

Louisiana has a lot going for it. It’s got the third lowest median home prices and fifth lowest utilities costs in the country, while still managing to maintain its own unique identity. From its vibrant music scene to its world-renowned cuisine, Louisiana’s Cajun Country has something for everyone.

Though mortgage payments in Orleans Parish average around $1,600 per month, home buyers looking beyond the Big Easy to cities like Baton Rougue or Shreveport can score a property for about $300-$600 less per month.

14. Georgia

-

Median income: $57,779

-

Median home price: $580,760

-

Mortgage-to-income ratio: 16.82%

The recent rise in home prices hit Georgia hard, with median home prices ranking in the bottom half of our list. A low cost of living makes up for it, though — in fact, Georgia is the fifth cheapest place to live in the country.

Georgia’s diverse culture, vibrant cities, and beautiful coastlines make it a great place to live. It’s home to both bustling metropolises like Atlanta and Savannah, as well as small towns with unique charms like Helen and Dahlonega.

15. Wisconsin

-

Median income: $60,945

-

Median home price: $510,900

-

Mortgage-to-income ratio: 14.77%

Wisconsin just barely squeezed out Missouri to finish off our list of the cheapest states to buy a house. Thanks to its low mortgage-to-income ratio, Wisconsin is a great state for first-time home buyers.

If you're a nature lover, you'll appreciate Wisconsin's natural beauty, with direct access to Lake Michigan and trails dotted throughout the state. Its cities aren't too bad, either. While Milwaukee carries a fairly hefty price tag, with the median mortgage payment in the city sitting just above $2,000 per month, Green Bay offers a cheaper alternative. It's still on the lake, and it's about $500 cheaper per month!

The 15 Most Expensive States To Buy a House

High home prices and mortgage-to-income ratios were the common factors in our list of most expensive states to buy a home.

Hawaii might be a paradise for vacationers, but it’s a tough place to buy a home. Not only could you expect to spend about 88% of your income on a mortgage, but it’s also got the highest cost of living in the entire country.

Massachusetts is another especially difficult state to buy a home in. High demand and low inventory in this small New England state mean its median home price is the highest in the country.

Check out the 15 most expensive states to buy a house below.

Methodology

To create this list we compiled median home values with data from the Federal Housing Finance Agency (FHFA), median incomes with data from the U.S. Bureau of Economic Analysis (BEA), average mortgage payments with data from the National Association of Realtors (NAR), average real estate taxes with data from the Internal Revenue Service (IRS), and cost of living data from the Council for Community and Economic Research (C2ER).

Using this data, we applied a rank to every state for each factor, and then used the following weighting formula to determine the ultimate ranking you see above:

-

Mortgage-to-Income Ratio: 45%

-

Median Income: 15%

-

Median Home Price: 15%

-

Average Real Estate Tax: 10%

-

Cost of Living: 10%

-

Utility Costs: 5%

FAQ

Here are some frequently asked questions about the cheapest states to buy a house:

Which state has the highest median home prices?

Massachusetts has the highest median home prices, according to data from FHFA, coming in at over $1.12 million.

Which state has the lowest median home prices?

The lowest median home prices can be found in West Virginia, at $305,080.

Which state has the lowest cost of living?

According to a 2022 survey by C2ER, Mississippi has the lowest cost of living in the United States.

Which state has the lowest real estate taxes?

Real estate taxes are determined by the county in which you purchase your house, but Delaware has the lowest effective real estate tax rate at just 0.37%, according to data from the IRS and FHFA.

Which state has the highest median income?

Massachusetts has the highest per capita income at $85,418, according to the latest data from BEA.

Which state has the lowest mortgage-to-income ratio?

Using data from NAR and BEA, we found that Illinois has the lowest mortgage-to-income ratio in the United States.

Find Your Dream Home Today

Whether you’re in the market for a big city condo or a countryside escape, UpHomes can help you find exactly what you’re looking for, no matter your budget.

Ryan Fitzgerald

Hi there! My name is Ryan Fitzgerald, and I am a REALTOR®. My goal is to help you learn more about real estate through our Real Estate Blog! Hopefully, you enjoyed the above blog post and it found a way to provide help or value to you. When you're ready to buy or sell a home of your own let us know here. Please feel free to join the conversation by dropping us a comment below.