Will the Housing Market Crash in 2023?

February 16th, 2023

A possible housing market crash in 2023 is worrisome for many Americans. With a market crash, also called a housing bubble burst, comes consequences like general economic downturn and instability. This makes it difficult for Americans to find their dream home.

Economists are hesitant to call the current market a housing bubble. A housing bubble typically has the following characteristics:

- Home prices rise faster than income or inflation

- Low availability of affordable housing

- High rates of subprime mortgages and predatory lending

- High mortgage rates

- Low home inventory, in general

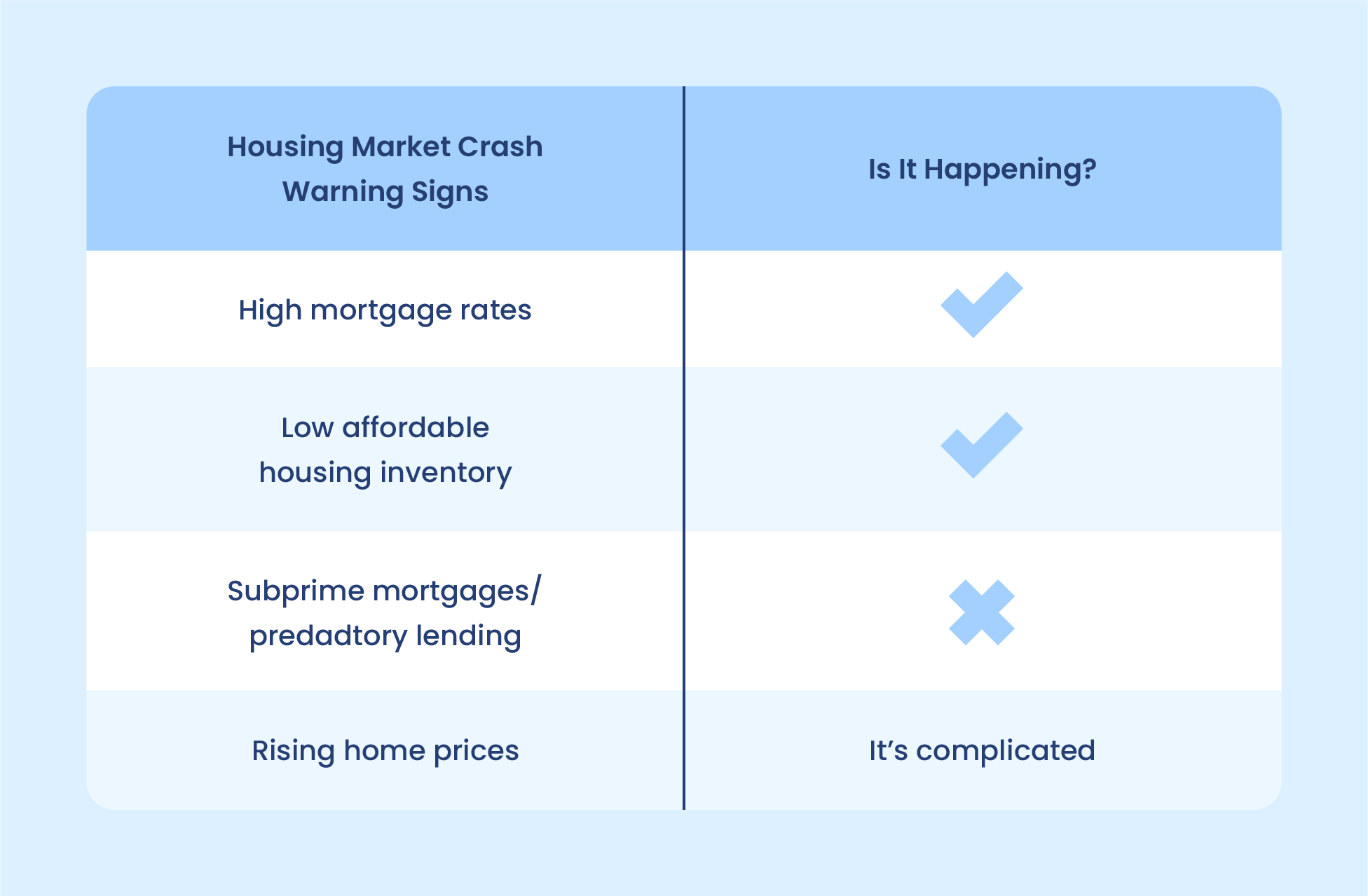

It's challenging to make the next housing crash prediction because the market can display many combinations of these features and not crash. When combined, these characteristics are generally a signal of poor market health. But economists have difficulty diagnosing a bubble until after it's already burst.

Many of these characteristics reflect the market, but experts aren't calling it a housing bubble yet because the market doesn’t reflect all the typical features.

It will take some time to see how everything shakes out, but our research indicates that the housing market won't crash in 2023.

Rising Home Prices

Typically, inventory follows the rule of supply vs. demand. Pricing trends for homes are a bit more complicated as federal regulations and interventions can affect the housing market outlook.

For example, federal regulations lowered mortgage rates at the onset of the COVID-19 pandemic to alleviate fears over a housing bubble. In theory, this should have made homes more affordable, but it had the following long-term effects:

- Created high demand for homes when inventory was low

- Pushed home prices up

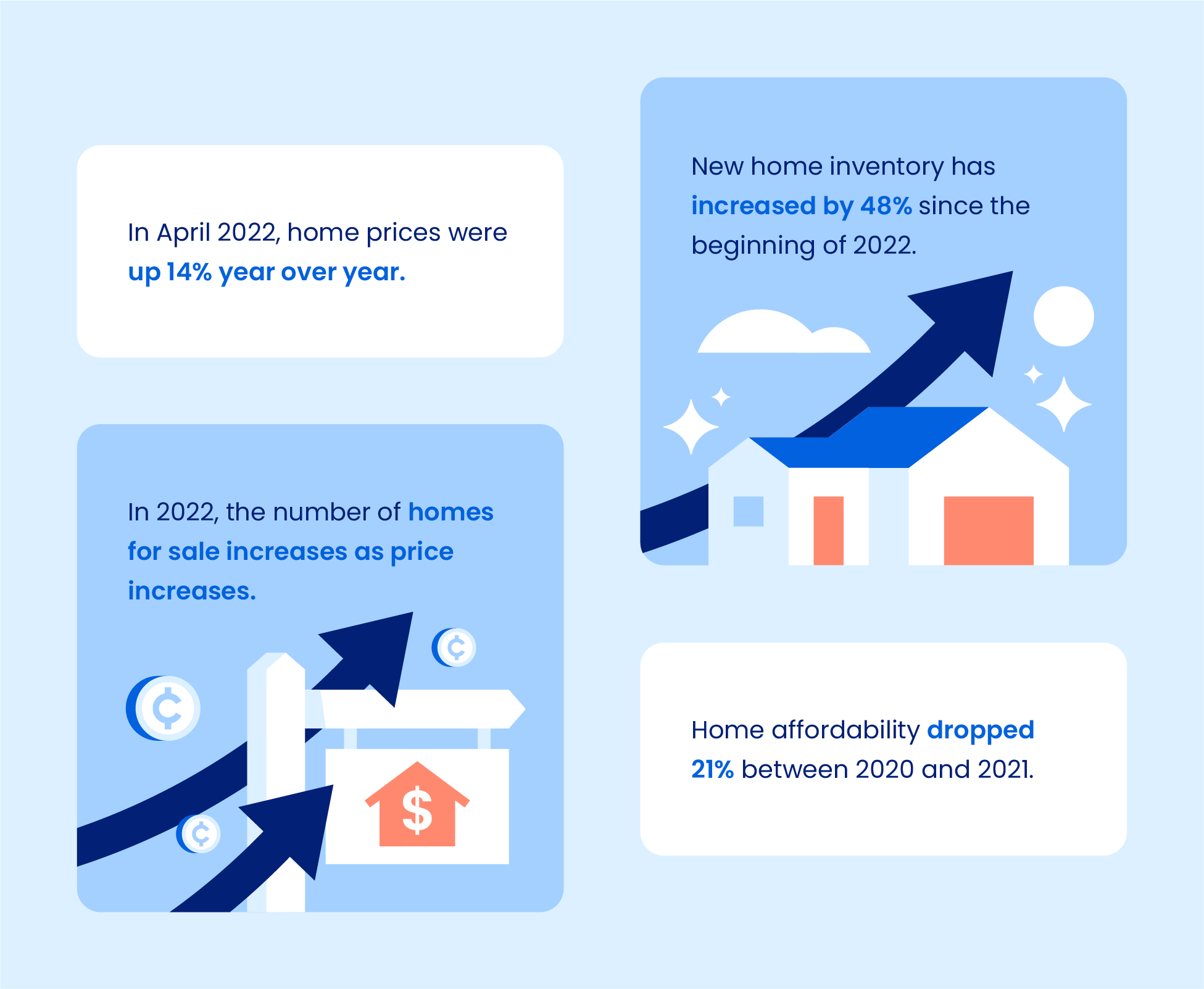

Because prices and demand continued to increase with such low inventory levels, the Federal Reserve then increased rates to cool the market. In April 2022, home prices were up 14% year over year.

Key takeaway: Rising home prices in 2022 aren't a reliable indicator of a 2023 housing bubble burst because pricing trends don't always follow basic economic rules.

Low Affordable Housing Inventory

The latest housing affordability index report shows that affordability dropped by 21% between 2020 and 2021. This is the most significant year-over-year decrease since 2013. Additionally, affordability in 2021 was 20% less than it was in 2013.

There's no shortage of competition in the affordable housing market. Everyone is looking for a good deal, including home flippers, which contributes to pricing out low-income Americans looking for a home.

The number of homes for sale increases as home prices increase. Essentially, it's a buyer’s market for the most expensive homes and a seller’s market for the most affordable homes.

Key takeaway: There's not enough affordable housing inventory in the United States to meet the demand. This causes more individuals to rent, often with higher monthly payments than mortgages.

Subprime Mortgages and Predatory Lending

Subprime mortgages and predatory lending refer to the unethical practice of lenders giving out loans to individuals who can’t truly afford them.

However, predatory lending is technically illegal, so it’s difficult to determine if it’s happening on a large enough scale to influence the housing market outlook.

Key takeaway: Mortgages are getting more challenging to qualify for. While this isn’t encouraging if you need a loan to buy a home, it’s a key reason why economists argue that we’re not in a housing bubble. However, if this difficulty leads to increased instances of subprime mortgages, it could become a risk factor for a housing bubble.

High Mortgage Rates

Mortgage rates are going up because of several economic factors. The Federal Reserve is the institution that sets national interest rates and helps regulate the value of the U.S. dollar.

As of August 2022, the Federal Reserve is raising its rates to help combat inflation. However, when Federal Reserve rates increase, mortgage rates do, too.

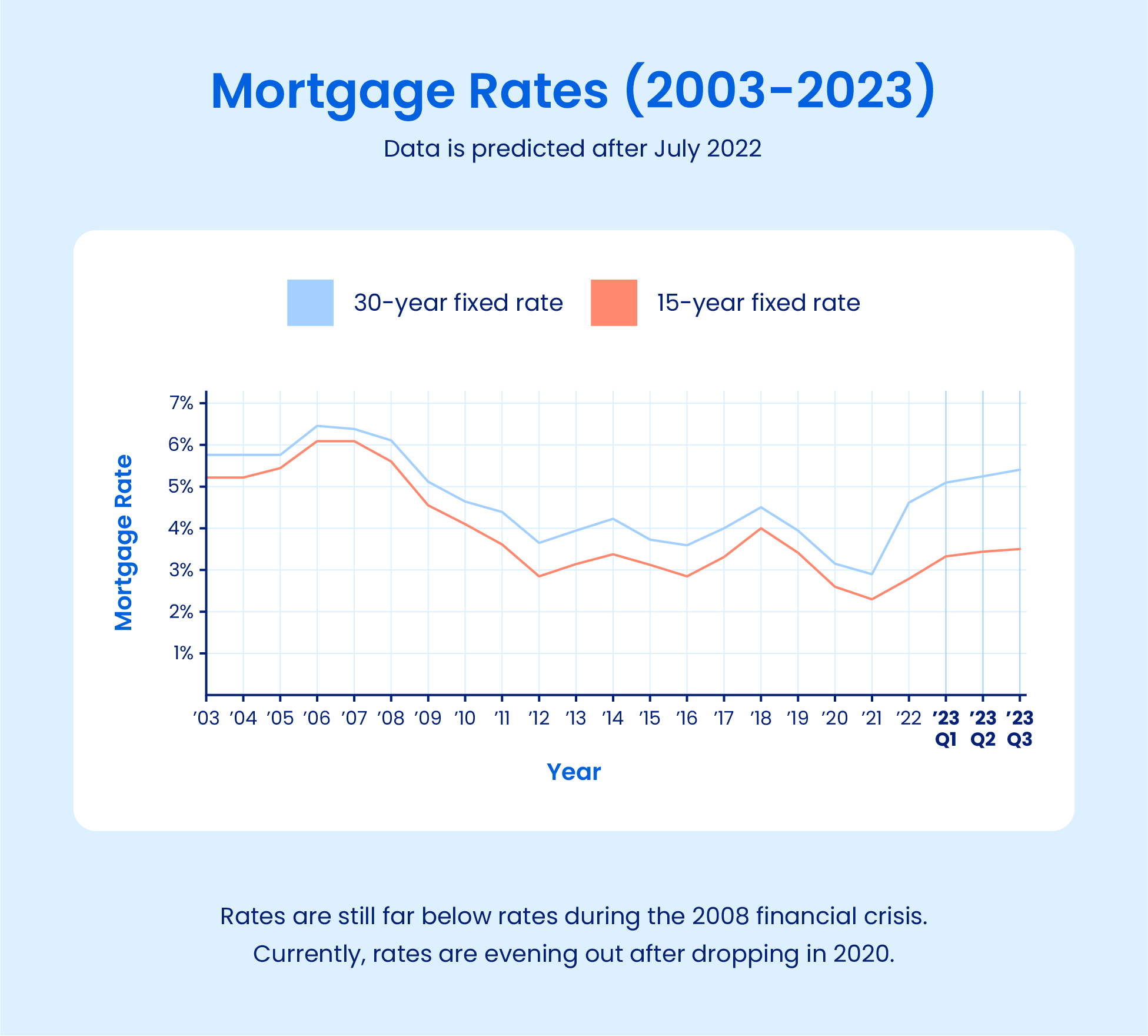

Between March 2021 and 2022, 15-year fixed mortgage rates increased by 44%, and 30-year conventional mortgage rates increased by 48% between April 2021 and 2022. This is the most significant year-over-year jump for each, and it will be essential to see if rates decrease as the year continues. Both rates are still significantly lower than during the 2008 financial crisis.

Key takeaway: Mortgage rates are rising, which is one of the indicators of a housing bubble. However, economists think rising mortgage rates will bring down home prices by the end of 2022, reducing the risk of a market crash.

Low Housing Inventory

Low housing inventory with high mortgage rates and prices creates extreme demand. Prices can only go so high before people aren’t able to purchase homes at all — this is when prices drop, the housing bubble pops, and the market crashes.

New home inventory has increased 48% since the beginning of 2022. This signifies that we might not be approaching a housing market crash.

Key takeaway: Housing inventory has been upward for most of 2022. This is hopeful because increased inventory can bring prices down and reduce the risk of a housing market crash in 2023.

Will Home Prices Go Down in 2023?

Due to conflicting data, it’s hard to say if home prices will decrease in 2023. However, experts are hopeful they will. Here’s why:

- Home prices generally decrease when mortgage prices increase.

- The average mortgage rate is 5.55% as of August 2022.

- The Federal Reserve is increasing rates, so mortgage rates will probably increase as well.

These factors indicate that prices may decrease sometime later in 2023. However, most experts predict prices will continue to grow during 2022 — just at a slower rate.

Housing Crash Predictions

The main challenge to the housing market in 2023 will be high home prices and difficulty qualifying for mortgages.

The Federal Reserve will likely increase rates to combat inflation if inflation continues. This will cause mortgage rates to grow, too. If this happens and other risk factors, such as a low inventory, occur, the housing market might crash.

The most important factors to keep an eye out for when gauging if the housing market will crash in 2023 are:

- Housing inventory drops

- Home prices skyrocket

- Mortgage rates accelerate

- Predatory lending occurs

There's not one lone indicator that predicts a market crash. Think about these factors as economic relationships that work together to tip the scale in favor of or against the likelihood of a crash.

Note: As of February 2023 mortgage rates are around the 6-6.5% mark.

FAQs

Will 2023 Be a Better Time To Buy a House?

2023 might be a better time to buy a house, depending on your financial situation. If you have the proper credit score for a mortgage and prices drop, you might get a better deal on a home. However, if you have difficulty securing a loan, it might become more difficult to find a new home in 2023.

Try our mortgage calculator to help determine if now's the right time to buy a home.

What Will Housing Interest Rates Be In 2023?

Many are hopeful that interest rates will decrease in 2023. Even if they don't fall, the growth will likely slow.

How Will the Housing Market Be In 2024?

As of this writing, it’s too soon to predict what the housing market will be like in 2024. Factors like federal intervention and inflation rate change too much to make reliable predictions about the 2024 housing market outlook.

When Will the Housing Market Go Down?

Housing prices and mortgage rates probably won’t decrease until mid or late 2023. However, this is difficult to predict because many unpredictable factors affect housing prices and mortgage rates.

Explore Your Options With UpHomes

Whether or not the housing market crashes in 2023, UpHomes is here to support you through it with resources for buyers and sellers alike if you’re wondering whether now’s the time to buy or sell your home, contact us to learn about your options.

Disclaimer: This post is for educational purposes only and shouldn’t be taken as financial advice.

Ryan Fitzgerald

Hi there! My name is Ryan Fitzgerald, and I am a REALTOR®. My goal is to help you learn more about real estate through our Real Estate Blog! Hopefully, you enjoyed the above blog post and it found a way to provide help or value to you. When you're ready to buy or sell a home of your own let us know here. Please feel free to join the conversation by dropping us a comment below.