How To Fix Your Credit Fast to Buy a House

October 01st, 2022

Months or even years before buying a home, prospective buyers should take a look at their credit scores and their credit history. It's especially important for first time home buyers who may not have as much credit history as those who have owned homes in the past. When buying a home, most lenders will want to see a score of 620, though some lenders will accept a score in the high 500s.

A good credit score improves the likelihood of qualifying for a home mortgage. It indicates to the lender that you’re responsible with your money and are likely to make timely payments on your loan. If your bad credit is halting the home buying process, we’ve put together a guide on the fastest ways to fix your credit to buy a house.

1. Review Your Credit Report

Before you start repairing your credit score to buy a house, you should understand what exactly needs to be fixed. Acquire a free copy of your credit report from the three reporting agencies: TransUnion, Equifax, and Experian. Read through each one carefully and pay attention to:

- The age of your credit: This indicates to lenders that you can successfully maintain credit over time. The longer you’ve had open lines of credit, the more positive an impact it’ll have on your score.

- Your credit utilization: Having high debt in relation to your available credit limit may cause your credit score to take a hit. Aim to keep your credit utilization rate below 30%.

- Your payment history: Lenders want to ensure you can pay your bills on time across all your lines of credit. If you’ve missed a payment here or there, or have defaulted on a line of credit altogether, there’s a good chance it’s reflected in your credit score.

- The number of credit lines you have open: The number of credit cards you use typically won’t have a noticeable effect on your credit score. However, multiple lines of credit can help or hurt you depending on other factors like payment history and debt. If you’re able to manage multiple lines of credit without missing payments or running up your balances, you’ll likely see a bump in your credit score.

Once you know what factors need to be improved, you can develop a game plan to raise your credit score to buy a house.

2. Correct Any Report Errors

There is only so much you can do about a recent late payment or a collection account. However, inaccurate late payments or collection accounts are often easier to fix.

While reading through your credit reports, you may uncover a few mistakes. With this information, you can file a dispute with the credit reporting agency. You will likely have to provide evidence of the mistake, so be sure to gather as much information as possible before disputing the error. This process should be done well before buying a home, as it may take a few months for the corrections to show up on your current report.

3. Pay Off Debt

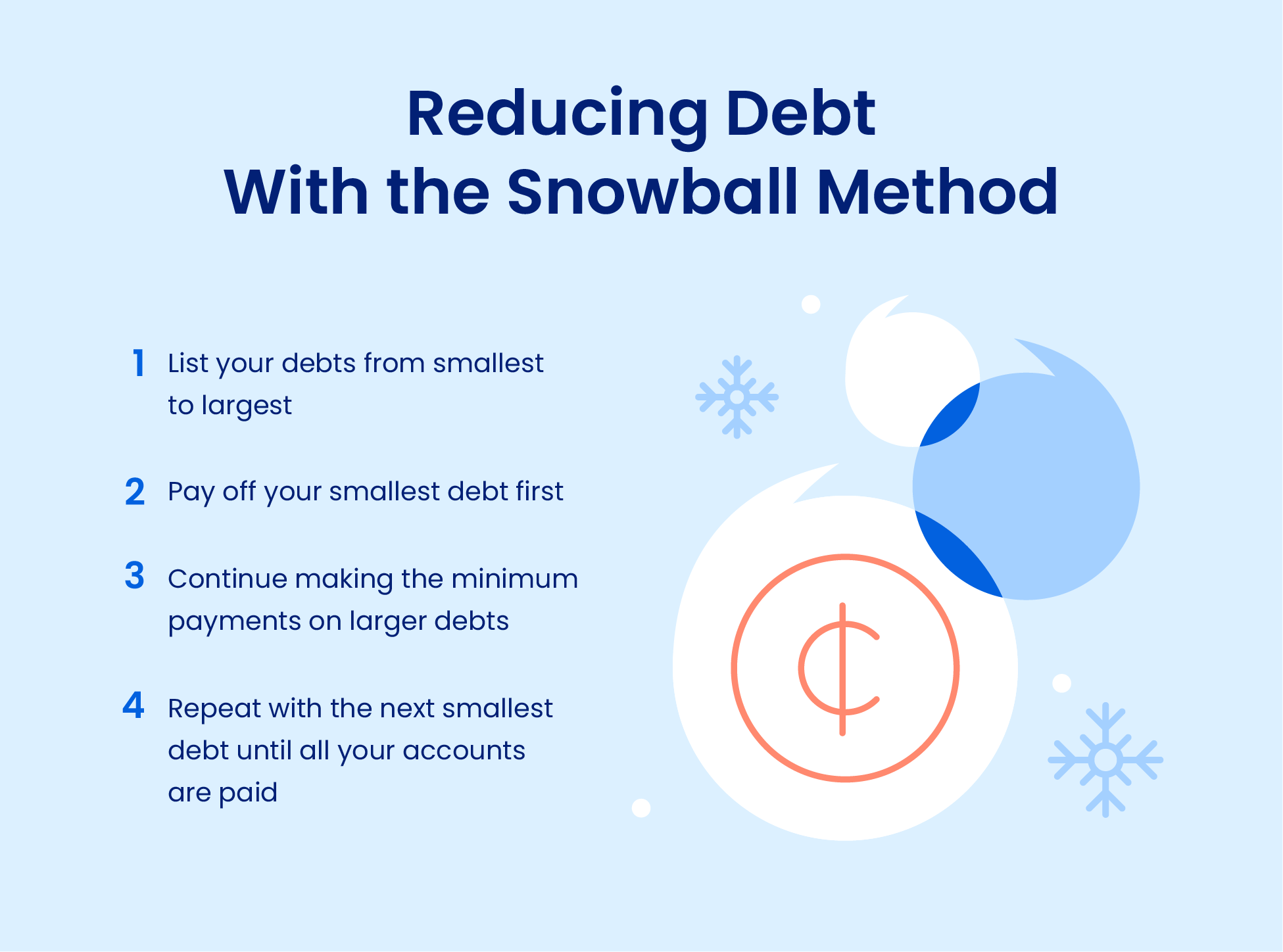

If the amount of debt you have is negatively affecting your credit score, focus on paying off as much of it as possible. This may be easier said than done, but many hopeful home buyers in the same position have found success using the snowball method to pay off their debt.

The snowball method is a debt reduction strategy that allows you to pay off your accounts in order from smallest to largest as quickly as possible, gaining momentum as you knock out balance after balance. This entails:

- Paying off your smallest debts first

- Only making the minimum payments on your largest debts until the smaller ones are paid off

- Contributing more to your larger debts once the smaller ones are totally paid off

Once you start seeing your balances reach zero, it’ll be easier to manage your spending and keep your credit in check.

4. Schedule Small, Regular Payments

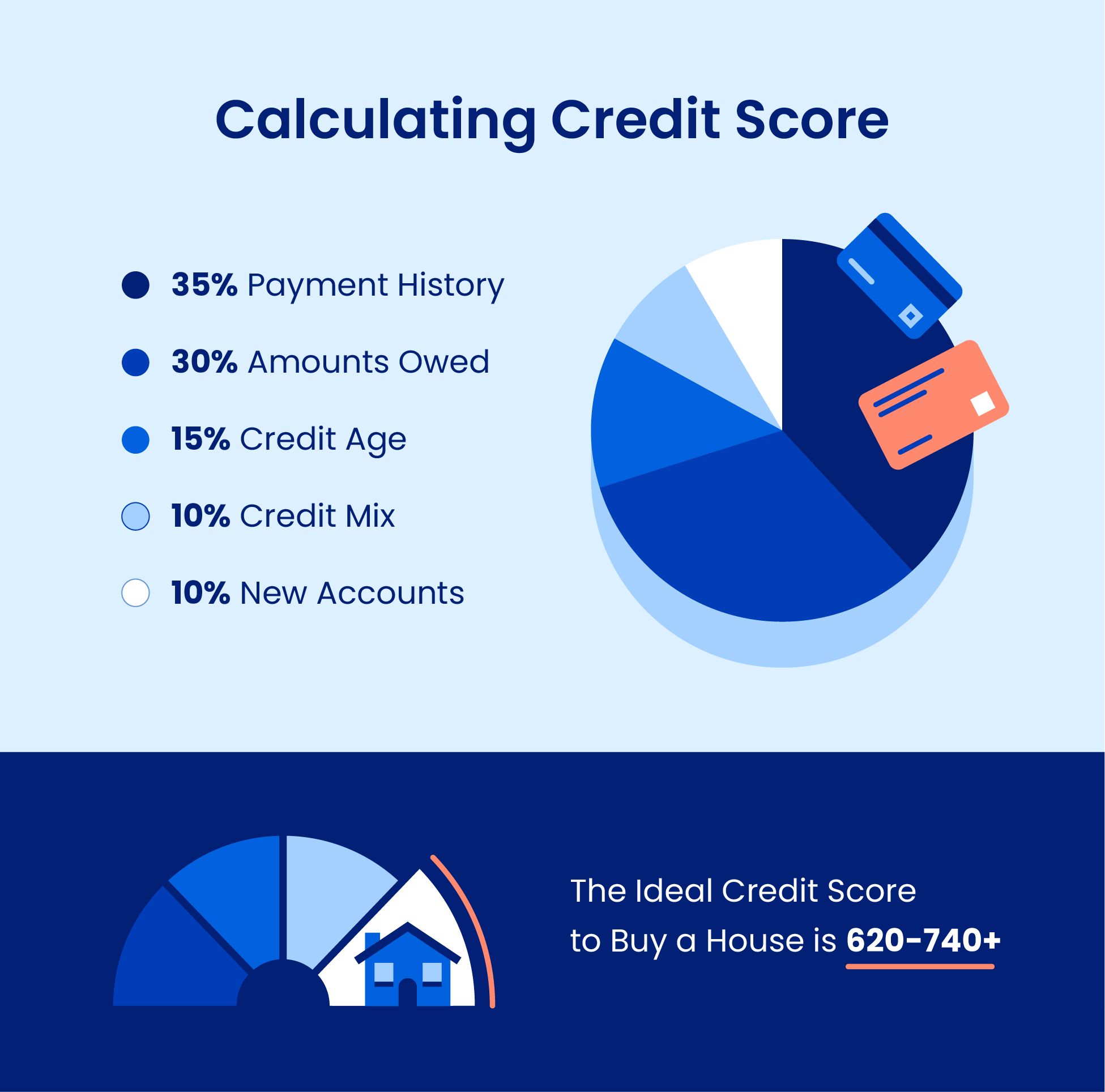

Your payment history makes up the largest percentage (35%) of your credit score’s calculation. This means one of the quickest ways to improve your score is to make at least the minimum payments on all your accounts every month — even better if you can pay off your entire balance each cycle.

Take control of your credit payments by setting alerts or notifications that your payments are due soon. If you struggle with managing multiple due dates, schedule one day out of the month when you make payments on all your lines of credit.

You can even set up automatic payments on your credit cards to avoid missing any payments or making a late payment. This will ensure you make regular, on-time payments while paying off your debt.

5. Avoid Making Credit Purchases

While managing your debt, it only makes sense to limit your credit purchases to what you can pay off every month. Adding to your debt won’t help you pay it off any faster, and could ultimately hurt your credit score if you allow your credit utilization to increase.

Using a credit card for everything creates a dangerous cycle that’s hard to break. Every time you swipe your card, your debt grows, and what you can’t pay off each month carries over to the next. As your debt increases, the interest on the unpaid balance will as well. If you’re struggling to keep up with the bill, it can be difficult to ease your way back into spending money that you actually have.

To avoid the temptation to use your credit card, try:

- Not using your credit card only — use debit or cash instead

- Building a monthly budget to get your spending back on track

- Transfering your remaining debt to a card with a 0% interest rate promotional period

- Only using your credit card for unforeseen emergencies, like medical expenses or home repairs

6. Monitor Your Credit Utilization

Speaking of credit utilization, having high debt in relation to available credit will typically make your credit score go down. For example, someone who owes $4,000 on a card with a $5,000 limit has an 80% credit utilization rate. Another person who owes $1,000 and the same limit has a credit utilization rate of 20%. Lower credit utilization usually means a higher credit score.

Some people try to “game the system” by opening new credit cards and applying for a balance transfer. This could be a risky choice for those who want to buy a home within a year or two.

While a balance transfer could decrease your credit utilization rate — which may increase your credit score — such short-term gains may not last. You may be enticed to run up your old card with a lot more debt, and opening new accounts may decrease your credit score by reducing your average credit age and placing a hard inquiry on your credit report.

7. Refrain From Closing Old Accounts

As you review your credit reports, it may be tempting to cancel old credit cards or accounts that are still open but have no balance. That old department store card from 10 years ago may feel like clutter on your credit report, but lenders may not see it that way. A good portion of your creditworthiness is tied to your credit history. This is in part why younger applicants may struggle to reach a high credit score.

Do not close out older lines of credit. Canceling old but current accounts could make your credit history appear much shorter and, therefore, riskier. It is typically considered best for people who want to buy a home to keep all existing accounts open and make sure each payment is on time.

8. Don’t Open New Lines of Credit

Getting a mortgage to buy a home is a big step for most people. Even those who have gone through the process before may not always make the best credit choices leading up to their purchase. Lenders may notice a sudden change in an otherwise steady credit report and assume the applicant is about to change the way they handle their money.

New accounts are a good example of this. When you have a variety of new accounts on your report, lenders may wonder if you’re going through financial trouble or if you’re planning to take on other debt after you buy a home. New car loans, credit cards, or even loans for furniture or home repairs could negatively impact your credit score. Lenders often prefer that borrowers have no new accounts within the past year.

Why Credit Is Important for Home Buyers

When interested buyers apply for a mortgage, they should understand how their credit history is used in the process. Your credit score and report make up a big portion of your ability to qualify for a mortgage, as well as the type and possible size of that mortgage.

To determine whether you’re approved for a mortgage and what interest rate to charge, lenders will examine your credit report, which includes:

- The number of loans or credit accounts you have: This includes closed accounts, like a student loan you’ve already paid off.

- The amount you owe on each account: Having debt doesn’t necessarily tarnish your credit report. However, if you are using a lot of your available credit, lenders may believe you’re overextended and at risk of defaulting.

- The types of credit accounts you have: Lenders like to see a variety of accounts on your credit report, such as installment loans (personal, auto, student) and revolving loans (credit cards).

- Your payment history: Lenders want to know that you’ll be responsible for making regular, on-time payments. Your payment history helps lenders calculate the amount of risk they will take on by offering you a home loan.

- Your credit score: Credit scores are quick snapshots of your credit health determined by your payment history, the amount of credit you owe, the length of your history, the types of accounts you have, and whether you’ve recently opened any new credit accounts. In general, the higher your credit score, the better terms you’ll get on a mortgage.

If your credit history shows a steady stream of on-time payments and a variety of accounts, a lender might feel more confident letting you borrow money for a house at a lower interest rate. On the contrary, if your credit is less than stellar — or you don’t have any credit at all — they might be more hesitant to approve you for a mortgage.

Credit is not a simple “pass or fail” criteria. While some people are unable to get a mortgage due to their credit history, those who will likely qualify still need to pay attention, as their score may determine the options available to them.

Having a strong credit score can also help you earn a better interest rate with your mortgage lender. Whether you’re looking to boost your score significantly or just climb up a few more points, you can take these steps to improve your credit.

FAQs

How long does it take to repair credit to buy a house?

The amount of time it takes to repair your credit to buy a house will largely depend on your payment history, credit age, and credit utilization. If you have just a few errors to dispute on your credit report, you could see your score rise in as little as a few months. But for the majority of borrowers, you likely won’t see a significant change in your credit score within the first six months of attempting to improve your score.

If you’re wanting to buy a house with no credit history, it will likely take a couple of years to establish a decent credit score and get approved for a mortgage.

Can a 500 credit score buy a house?

If your credit score is 500 or above, you may be able to take out an FHA loan to buy a home, depending on the size of your down payment. You will need a 10% down payment to qualify for an FHA loan if your credit score is 500.

What is a good credit score to buy a house?

Having a FICO credit score of 720 is pretty good, and will open up favorable loan terms for some borrowers. Those who have a score of 740 or higher may even do a bit better if all else is the same. As a result, buyers with good credit may want to look for a balance of at least maintaining their score and making wise decisions about improvement wherever they can.

Should I fix my credit before buying a house?

Unless you plan on making an all-cash offer, you should definitely consider fixing your credit before purchasing a house. Those with a credit score of less than 700 may struggle to qualify for a home loan — and the home loans they do manage to get approved for will likely have high interest rates and less-than-favorable terms. Fixing your credit will take some time and effort, but it will save you money on your home in the long run.

It’s best to improve your credit in advance of buying a home. With these tips, interested home buyers can benefit from the boost in their credit score before they apply for a mortgage.

Ryan Fitzgerald

Hi there! My name is Ryan Fitzgerald, and I am a REALTOR®. My goal is to help you learn more about real estate through our Real Estate Blog! Hopefully, you enjoyed the above blog post and it found a way to provide help or value to you. When you're ready to buy or sell a home of your own let us know here. Please feel free to join the conversation by dropping us a comment below.